In this issue:

- $50.6 billion state budget passes

- Some taxes already going up

- Reminder about our open house

- Illinois headlines

Thank you for reading my e-newsletter. For the latest news from state government or to share your ideas and opinions, please visit my legislative website at repbunting.com.

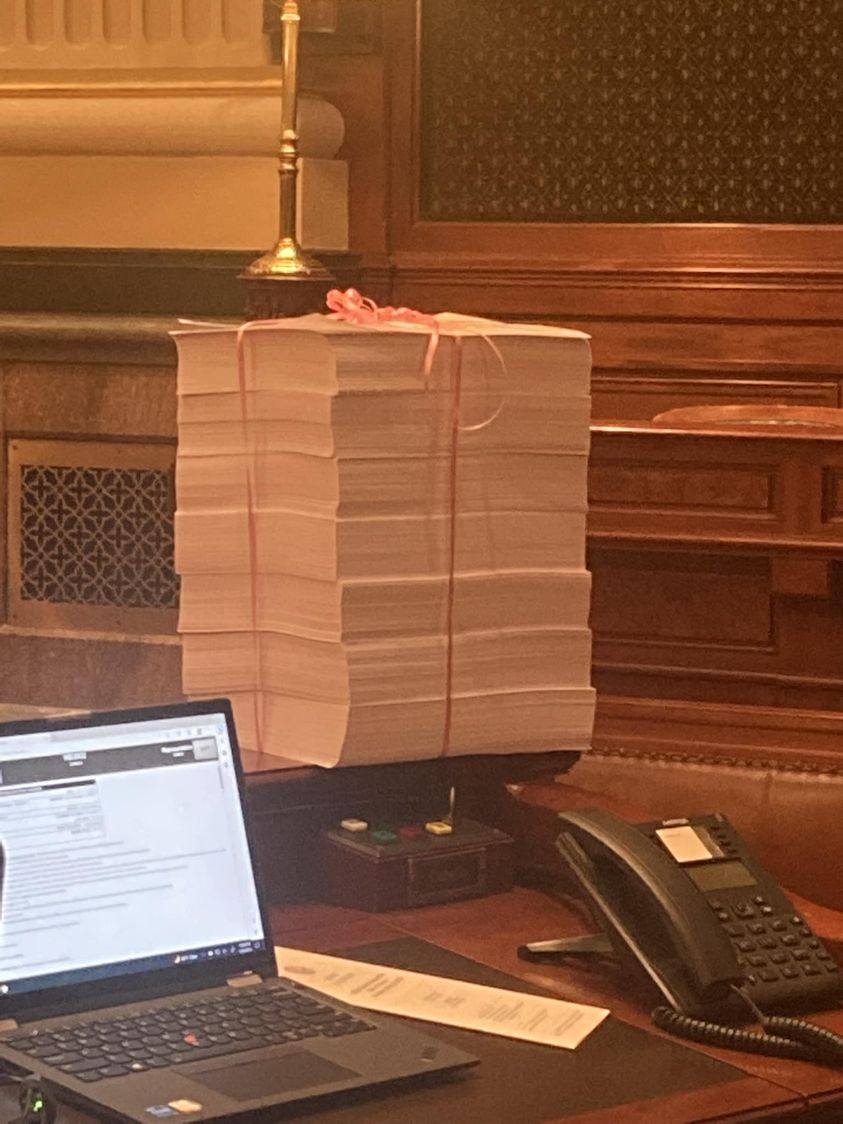

$50.6 billion state budget passed just after 2 a.m. on Saturday

It was a very late night at the Capitol on Friday, as the House stayed in session well past midnight to pass a $50.6 billion state budget for next year.

The budget locks in some long-term spending which we do not yet know how to pay for. It does not include the funding necessary to pay for upcoming contractually-obligated state employee pay raises. It shortchanges hospitals and caregivers for the developmentally disabled. It adds $550 million in funding for health care for undocumented immigrants, but leaves unresolved the question of how to pay for the other $550 million that this program is expected to cost. It even includes a pay raise for state legislators. And it tries to balance the budget on the backs of local government.

The budget ran more than 3400 pages long and was not finalized until late on Thursday night. All these gimmicks and bad budgeting practices will hurt Illinoisans for generations. These bad decisions and unsustainable promises will almost certainly lead to tax increases or cuts in services down the road.

If people in our area ran their businesses like this, they’d be bankrupt.

I voted No.

Some taxes already going up

Illinoisans will start to pay a bit more in taxes in the coming weeks and months due to an automatic hike and the expiration of a couple of tax holidays.

Gas taxes have been slowly increasing to pay for the infrastructure bill which was passed and signed in 2019. It included an automatic increase in gas taxes to keep up with inflation. This summer, the gas tax will increase by just over three cents per gallon on July 1.

The gas tax hike will hit right around the same time that a couple of other tax holidays expire. Last year, while Illinoisans were dealing with 40-year highs in inflation, the state suspended the sales tax on groceries and the sales tax on school supplies and clothing. Neither of these tax holidays was extended.

In total, the expiration of these two sales tax holidays will mean Illinoisans will pay an additional $430 million in sales taxes in the upcoming year. Meanwhile, Illinois families will still be battling higher prices because of inflation.

Some spring session stats

In all, there were 4103 bills introduced in the spring session. The House passed 709 of them. A total of 564 bills passed both the House and Senate and went to the Governor. Of those, 501 were sponsored by Democrats and 63 were sponsored by Republicans.

Once he receives them, the Governor will have 60 days to decide whether to sign them into law or veto them. The Illinois Constitution also grants governors a line-item or “amendatory” veto which allows him to sign a bill with suggested changes and then send the bill back to the legislature which could either agree to the changes or reject them.

Among those bills which did not pass this spring were my bill to improve the way we recruit and retain police officers, legislation to extend the popular and successful Invest in Kids tax credit scholarship program, or a bill to reform the Department of Children and Family Services to better protect kids in its care.

The House and Senate also failed to act on significant ethics reform, in spite of the continuing scandals we have seen year after year.

Reminder: District office grand openings June 8 & 9

Just a reminder about our upcoming district office grand openings on Thursday June 8 and Friday June 9.

I am inviting everyone to stop by my district office in Watseka on Thursday June 8 between 2 p.m. and 4 p.m. for our open house. That office is located at 342 W. Walnut Street.

On Friday June 9 we will be opening our new district office in Dwight at 132 E. Main Street, from 1 until 3 p.m.

My staff and I will be on hand to greet everyone and to answer questions or share information on the state government services we can provide. We will have some light refreshments available as well. I hope you will stop by.

Our current bill backlog

When a vendor provides the state with goods and services, they submit the bill to the Illinois Comptroller for payment. The Comptroller processes the paperwork and pays the bill when funds are available in the state’s checking account. Currently the total amount of unpaid bills is $1,300,272,841. This figure changes daily. Last year at this time the state had $2.1 billion in bills awaiting payment. This only includes bills submitted to the Comptroller for payment, not unfunded debts like the state’s pension liability, which is well over $100 billion.

Illinois headlines

Top 5 invasive plants in Illinois which could ruin your yard

New fund helps Central Illinois farmers in crisis

Paxton native Gina Miles living her dream after winning ‘The Voice’